Marketplace B2B: SEPA direct debit payment method

- Arnaud

- 9 minutes reading

The SEPA Direct Debit payment method is an essential payment solution in Europe, particularly well-suited for B2B transactions. This system simplifies and automates recurring payments in a seamless and secure manner. Learn how to effectively integrate SEPA Direct Debit into your B2B marketplace to optimize transaction management and enhance customer experience.

👋 No time to read the entire article? Find the summary here.

1. What is SEPA direct debit?

The SEPA direct debit payment method (Single Euro Payments Area) is a payment system that harmonizes euro-denominated banking transactions across 36 European countries. By integrating SEPA direct debit into your B2B marketplace, you facilitate the automation of payments between businesses, reducing administrative burden and enhancing transaction security.

SEPA direct debit enables recurring payments (e.g., subscriptions, monthly invoices, etc.) by directly debiting the client’s bank account with prior authorization. This payment method is ideal for professional marketplaces managing regular purchases or long-term subscriptions. It can also be used for one-time payments.

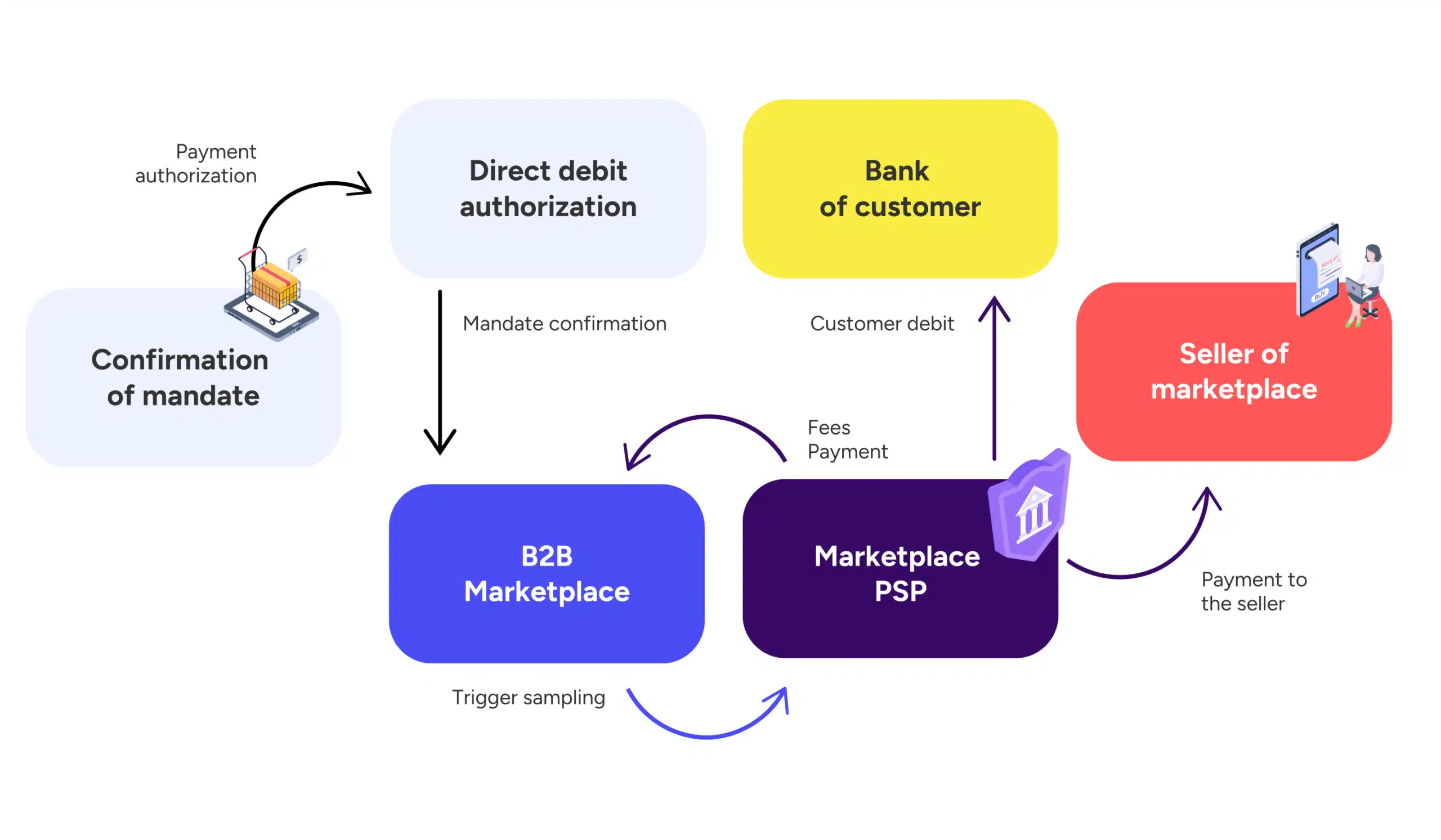

The diagram below illustrates the SEPA direct debit payment process in a B2B marketplace, highlighting the different stages and interactions between key stakeholders:

The diagram shows how, after obtaining the customer’s SEPA direct debit mandate authorization, payments are automated and secured throughout the transaction process.

2. Why use SEPA direct debit in a B2B marketplace?

Integrating the SEPA direct debit payment method into a B2B marketplace offers numerous advantages for both platform operators and business customers:

Payment automation

Payments can be scheduled to be automatically debited on specific dates. This simplifies the management of recurring payments without manual intervention, ensuring transaction continuity.Enhanced security

The SEPA direct debit system adheres to strict European banking security standards. Transactions are highly secure, thanks to strong customer authentication, providing increased protection against fraud.Reduced risk of non-payment

With automatic direct debit, payments are made according to a defined schedule, significantly reducing the risk of delays or non-payment. This allows businesses to better manage their cash flow and avoid payment disruptions.Improved cash flow management for buyers

Companies can plan their payments in advance, knowing that direct debits will be made on set dates, facilitating better cash flow management and increasing their confidence in the platform.

“This solution automates recurring transactions, enhancing security and reducing the risk of non-payment. By adopting a scalable solution like Origami Marketplace and its partners, you ensure smooth management that complies with European standards, offering your clients a simplified and reliable payment experience.”

Alexandre Duquenoy

→ Connect with our B2B solutions expert.

3. Benefits of the SEPA direct debit payment method

Using the SEPA direct debit payment method provides several strategic advantages for B2B marketplaces:

- Automation and time savings: Automating recurring payments significantly reduces the administrative burden associated with managing invoices and payment follow-ups. This frees up time for accounting and financial teams.

- Customer trust and loyalty: SEPA direct debit is perceived as a reliable and secure payment method, increasing your marketplace’s credibility. Customers benefit from complete transparency in their transactions, enhancing their user experience.

- Simplified cross-border transaction management: Thanks to the SEPA standard, payments are harmonized across 36 countries, enabling your marketplace to manage cross-border transactions without added complexity.

- Reduced operational costs: Automatic direct debit minimizes costs related to manual payment processing, invoice reminders, and late payment management.

Download our free requirement specification template

Access essential functionalities to successfully build your C2C, B2C, or B2B marketplace. This simple-to-use backlog template will support you at every project stage.

4. How to integrate SEPA direct debit in a B2B marketplace

To successfully integrate the SEPA direct debit payment method into your B2B marketplace, follow these steps:

Check the eligibility of your marketplace

Ensure that your marketplace complies with SEPA standards. This involves working with banks or payment providers that are members of the SEPA network and capable of handling these transactions.Obtain direct debit authorization from clients

Before implementing automatic debits, you must obtain a SEPA direct debit mandate signed by each client. This mandate authorizes the debit of their bank account on specified dates for recurring payments. Authorization can be obtained online via electronic signature.Automate direct debit management

Use a payment management solution capable of automating SEPA direct debit payments. This allows you to schedule payments at regular intervals (monthly, quarterly, etc.) and automatically generate corresponding invoices. Additionally, your system should be able to manage any payment rejections or refusals.Provide transparent payment tracking

Offer your clients an intuitive dashboard where they can track the status of their SEPA direct debits, review invoices, and manage payment authorizations. Ensure that payment notifications (such as payment reminders or confirmations) are automatically sent, providing full transparency throughout the process.Comply with European regulations

Ensure you adhere to the legal and regulatory requirements of SEPA direct debit, particularly regarding data protection and authentication. Also, make sure you respect the mandated timelines for direct debits and cancellations to maintain your platform’s compliance.

The SEPA direct debit payment method is essential for any B2B marketplace operating in Europe. It simplifies recurring payment management, enhances security, and ensures transaction automation. By integrating this solution into your marketplace, you offer clients an optimized B2B purchasing journey while reducing the risk of non-payment.

To maximize the benefits of this approach, adopt a scalable solution like Origami Marketplace, which natively integrates features such as quote management and volume pricing. With these tools, you can transform your marketplace into a high-performing, profitable platform tailored to the complex needs of B2B. If you wish to discuss this topic or your professional needs, our team is at your disposal.

Key takeaways:

- Automation: Reduce administrative tasks with automated recurring payments.

- Security: Benefit from SEPA direct debit’s stringent security standards.

- Cash flow management: Offer clients better payment planning.

- Compliance: Meet European regulations for a seamless integration.

- Scalable solution: Use tools like Origami Marketplace for comprehensive and efficient B2B transaction management.

Discover how the Origami Marketplace API and its network of partners can transform your business, regardless of size, with its innovative marketplace model.