Allowing transactions without payment on a B2B Marketplace

- Arnaud

- 6 minutes reading

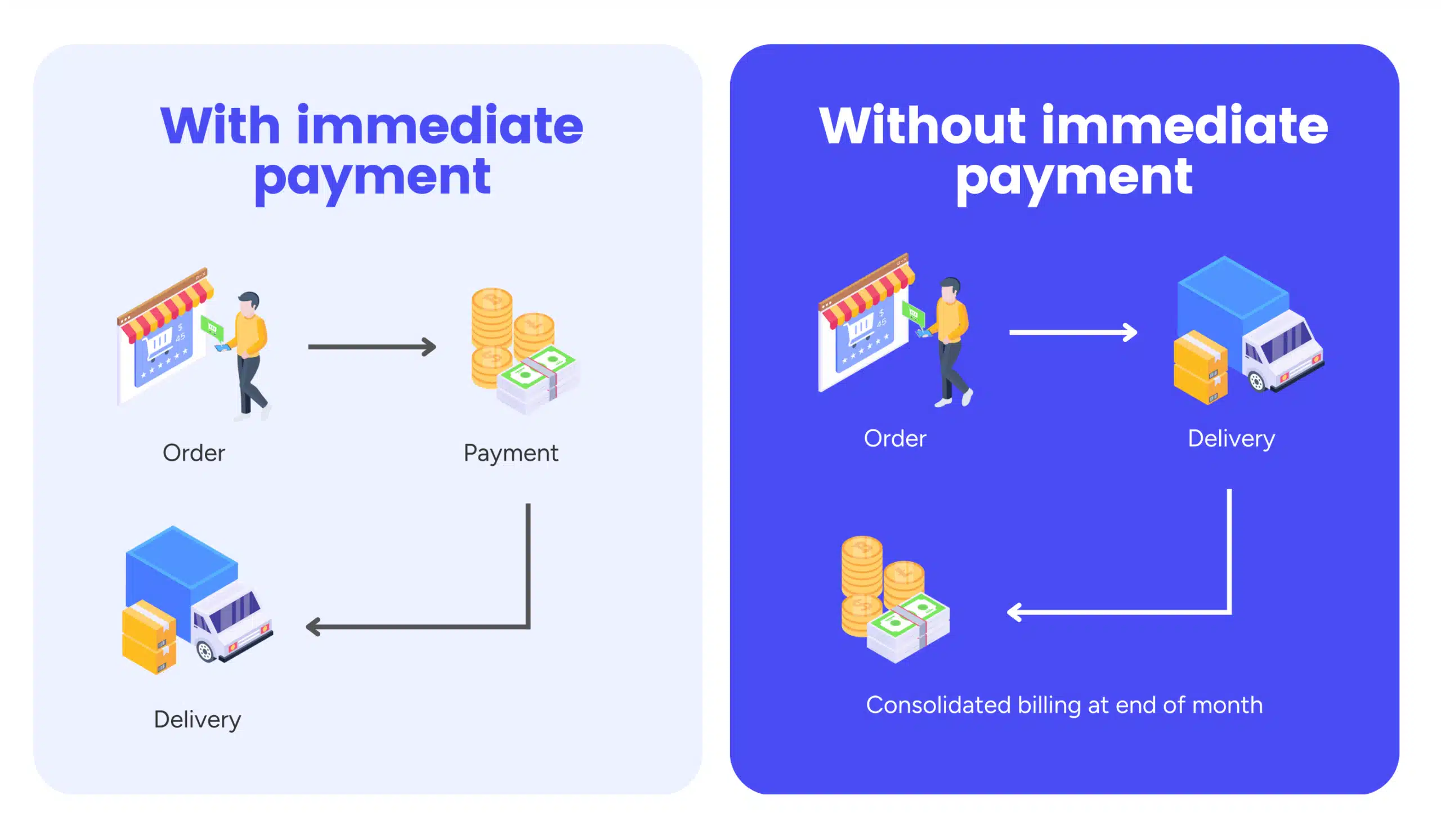

In an internal marketplace, some transactions do not require immediate payment, such as contractual orders or recurring purchases to be invoiced at the end of the month. Managing these transactions without immediate payment is therefore essential to streamline the billing process and meet the specific needs of professional buyers.

Discover how this feature can optimize the efficiency of your B2B marketplace and enhance your customer satisfaction:

- Why manage transactions without immediate payment in an internal marketplace?

- Benefits of transactions without immediate payment

- How to integrate the management of non-immediate payment transactions in your internal marketplace?

- Use Cases: Concrete examples of companies using non-immediate payment transaction management

👋 No time to read the entire article? Find the summary here.

1. Why manage transactions without immediate payment in an internal marketplace?

In B2B commerce, buyers often operate based on long-term supply contracts or recurring purchases. In these situations, payment is not made at the time of order but at a later date, typically under agreed terms (monthly, quarterly payments, etc.). This method offers several benefits:

- Centralization of purchases: Companies can consolidate their orders into a single invoice, facilitating financial management.

- Simplified accounting processes: A single payment for multiple transactions at the end of the month reduces the administrative burden on accounting departments.

- Optimization of internal processes: Large companies often prefer this approach to streamline cash flow and budgeting, providing a comprehensive overview of their expenses.

In B2B, this deferred payment method is not just a convenience but a business standard for many industries.

"Choosing the right SaaS solution is important, as it allows you to invoice, centralize, and automate the tracking of non-immediate payment transactions. This simplifies accounting and offers a smooth and coherent user experience."

Alexandre Duquenoy

→ Connect with our B2B solutions expert.

2. benefits of transactions without immediate payment

Integrating the management of non-immediate payment transactions in your internal marketplace can facilitate the B2B purchasing journey and offer several tangible benefits for both you, as the platform operator, and your professional clients:

1. Greater flexibility for buyers

By allowing customers to place orders without having to pay immediately, you simplify their purchasing process. They can make orders more easily and frequently without worrying about instant payment management.

2. Improved business relationships

Offering deferred payment terms shows that you understand the specific needs of businesses. By providing this flexibility, you strengthen customer trust and loyalty, especially for clients with large purchasing volumes.

3. Optimization of accounting management

For your clients, consolidating multiple transactions under one invoice simplifies their financial management. They can centralize payments, reducing administrative tasks and the time spent tracking multiple invoices.

4. Increased order volumes

By reducing purchasing barriers (such as immediate payment obligations), you encourage clients to place more orders and increase their purchase sizes, boosting your overall sales.

Download our free requirement specification template

Access essential functionalities to successfully build your C2C, B2C, or B2B marketplace. This simple-to-use backlog template will support you at every project stage.

3. How to integrate non-immediate payment transaction management into your internal marketplace?

Here are some steps to effectively integrate this feature into your internal marketplace:

1. Define eligibility criteria

Before offering this option, it is essential to establish clear criteria to determine which clients can benefit from it. For instance, this feature may be reserved for clients with ongoing contracts, substantial purchase volumes, or a consistent and reliable order history.

2. Automate billing and payment tracking

Implement an automated system capable of generating summary invoices that group multiple orders into a single document, based on the defined frequency (monthly, bi-monthly, etc.). Synchronizing this feature with the customer account management system is crucial for seamless tracking of payments and invoices.

3. Transparent transaction tracking

Ensure buyers have access to an intuitive dashboard where they can monitor the status of their orders, pending payments, and invoices. This enhances transparency and provides better control over expenses for clients, increasing overall satisfaction.

4. Integration with ERP or accounting systems

For client companies, it can be very beneficial if your internal marketplace is integrated with their ERP or accounting systems. This enables smooth data management between their internal platform and your marketplace, making the processing of invoices and deferred payments easier.

4. Use Cases: Concrete examples of companies using non-immediate payment transaction management

1. Industrial supplies wholesalers

An industrial equipment supplier allows its regular clients to place orders throughout the month without immediate payment. At the end of each month, a single invoice is generated, consolidating all orders and simplifying accounting for buyers.

2. Internal services platform

An IT services company offers its clients the ability to subscribe to multiple services and pay at the end of the quarter once services are rendered. This helps client companies better manage their budgets while continuing to benefit from uninterrupted services.

3. Office supplies marketplace

An office supplies platform allows its clients to place recurring weekly orders, with a single monthly invoice. This system enables companies to consolidate their purchases into one invoice while regularly ordering to maintain stock levels.

Managing transactions without immediate payment is a crucial feature to improve the customer experience in an internal marketplace. It offers professional buyers increased flexibility, simplifies financial management, and strengthens business relationships. By integrating this feature, you create a trustworthy and convenient environment, boosting customer loyalty and encouraging repeat purchases.

To fully leverage this feature, opting for a scalable solution as Origami Marketplace is essential. This platform naturally integrates non-immediate payment management along with other strategic tools, such as automatic invoicing and deferred payment management, to create a seamless and high-performing B2B experience. If you wish to discuss this topic or your professional needs, our team is at your disposal.

Key Takeaways:

- Increased flexibility: Allow buyers to order without immediate payment, facilitating recurring and contract-based purchases.

- Accounting optimization: Consolidate multiple transactions into a single invoice, simplifying financial management for clients.

- Enhanced business relationships: Offer deferred payment options to build client loyalty and trust.

- Increased orders: By removing the barrier of immediate payment, encourage larger purchase volumes.

- Seamless integration: Connect the marketplace to clients’ ERP systems for automated payment and invoice management.

Discover how Origami Marketplace’s API and its network of partners can transform your business, regardless of size, with its innovative marketplace-based solution.