Procurement: how B2B marketplaces are redefining supplier management

- Emeline Kerloch

- 10 minutes de lecture

Traditional supplier management can be challenging for businesses. Based on manual processes, it is a source of inefficiency and a major strategic obstacle. Accounts payable teams, for example, can spend up to 84% of their time on repetitive manual tasks such as data entry or error correction. This drain on resources, combined with fragmented data silos and a lack of visibility, means the procurement function is confined to a reactive role that is often disconnected from the company’s strategic objectives.

The B2B marketplace is therefore not just an evolution, but a true structural revolution. By centralising interactions, automating end-to-end supplier lifecycles, and providing unparalleled transparency, it is disrupting outdated models and establishing a new, agile, resilient, and collaborative procurement ecosystem. It is transforming supplier management from a series of isolated transactions into dynamic, value-creating partnerships.

This article takes an in-depth look at how the B2B marketplace is reinventing the entire supplier relationship. From automated sourcing and onboarding to real-time performance management, we will explore how this transformation delivers spectacular efficiency gains and redefines the role of procurement as a driver of competitiveness and innovation across the entire organisation.

I. The legacy of the past: dismantling traditional supplier management

In order to grasp the extent of the transformation brought about by B2B marketplaces, it is crucial to examine the inherent limitations and systemic inefficiencies of traditional supplier management models. While these approaches may be familiar, they pose a significant obstacle to the agility, profitability and resilience of modern businesses. This section sets out the compelling business case for change by outlining the operational flaws and strategic limitations inherent in the current situation.

I. Manual processes and disjointed workflows

Traditional supplier management is characterised by heavy reliance on manual, fragmented, time-consuming processes that generate hidden costs and significant productivity losses.

Manual tasks

The daily work of procurement and invoicing teams is dominated almost entirely by manual tasks. According to a study by the Institute of Finance & Management (IOFM), an accounts payable professional spends up to 84% of their day on manual, repetitive tasks such as data entry, chasing approvals, correcting errors, and responding to supplier enquiries. This staggering statistic is more than just an inconvenience; it represents a drain on skilled resources. Similarly, logistics teams can spend up to 50% of their time on manual processes, while nearly 28% of procurement professionals spend over 20 hours per week resolving issues arising from manual supplier management.

Fragmentation des processus

The supplier lifecycle is rarely managed within a single system. Instead, it is scattered across a multitude of disconnected tools, such as paper documents, complex spreadsheets and endless email chains. This fragmentation creates information silos within the purchasing function and between different departments, such as purchasing, finance and logistics. Without an integrated system, communication becomes disjointed, critical processes such as purchase order processing are significantly delayed, and priorities become misaligned across functions.

High error rate and rework

Manual data entry is prone to error by its very nature. According to one report, 47% of errors in procurement are directly attributable to manual data entry. These errors, whether incorrect orders, duplicate payments or billing discrepancies, result in more than just direct financial losses. They also lead to a considerable amount of time being spent on rework and correction, which compromises data integrity and can lead to strategic decisions being made based on incorrect information.

2. Quantifying lost time and financial losses: the high cost

The inefficiency of traditional processes results in direct and indirect costs that weigh heavily on business performance.

Direct operating costs

Manual processes can be extremely costly. According to The Hackett Group, organisations can reduce their procurement costs by up to 30% by automating key activities. The cost of processing a single paper invoice can range from $9 to $20; this figure drops to just $2–$4 with automation. For a large company processing thousands of invoices per month, this equates to millions of pounds in potential annual savings*

The opportunity cost of inaction on a strategic level.

Although less visible, the most significant cost is strategic. When highly skilled procurement professionals spend most of their time on low-value administrative tasks such as order tracking or data correction, they are not focusing on activities that create real value for the business. Strategic sourcing, market analysis, supplier relationship management, innovation promotion and proactive risk mitigation are neglected in favour of managing daily emergencies. This prevents the procurement function from becoming a true strategic partner for the company.

Financial leaks

Inefficiencies and slowness in processes result in direct financial losses. For example, delays in invoice processing mean that companies consistently miss opportunities for early payment discounts. Even worse, they can result in late payment penalties, costing money and damaging relationships with suppliers.

3. The visibility black hole: data silos, uncontrolled spending, and hidden risks.

One of the most critical shortcomings of traditional models is the almost total lack of centralised, real-time visibility of spending and suppliers.

Procurement data is siloed, making it impossible to get a complete picture, and this endemic lack of visibility is a major issue. According to a GEODIS survey, only 6% of companies believe they have full visibility of their supply chain. This opacity even extends to direct partners: 43% of organisations admit to having limited or no visibility of the performance of their tier-one suppliers. Visibility of lower tiers of the supply chain is even poorer, with 84% of companies lacking visibility beyond their tier one suppliers.

Maverick spending and non-compliance: without a centralised, simple, and intuitive purchasing system, employees often bypass official channels. They make ‘maverick’ purchases from unlisted suppliers at non-negotiated prices and outside company policies. This undermines the purchasing department’s negotiation efforts, increases costs, and introduces significant compliance risks.

Reactive and ineffective risk management: the lack of a consolidated view of data makes risk management inherently reactive. Critical supplier risks, whether financial, operational, regulatory or reputational, are often only identified after a disruption has occurred. A Gartner study found that 83% of legal and compliance executives identified supplier risks after completing the due diligence process, highlighting the limitations of manual and static checks.

The inefficiencies of traditional supplier management are not isolated problems, but rather components of a vicious cycle that systematically undermines the strategic potential of the procurement function. Manual, error-prone processes consume most of professionals’ time, preventing them from focusing on high-value, strategic activities, such as in-depth market analysis or supplier innovation management. This lack of strategic engagement results in purely transactional, and often conflictual, relationships with suppliers, stifling collaboration and innovation. The result is a less resilient and less competitive supply chain, which reinforces the role of procurement as an administrative, reactive cost centre rather than a strategic partner. Therefore, the real cost of manual processes is not just a matter of overheads, but also the systemic suppression of the procurement function’s potential. The marketplace model breaks this cycle by automating tactical processes and freeing up time for strategic activities.

II. Understanding the B2B marketplace paradigm

Faced with the limitations of traditional supplier management, the B2B marketplace is emerging not as a mere improvement, but as an entirely new procurement operating system. It offers a comprehensive solution to issues such as inefficiency, lack of visibility, and risk management by fundamentally changing the way companies engage with their supply chain.

1. Defining the modern purchasing hub: from e-procurement to collaborative networks

A B2B marketplace is a digital platform that centralises and facilitates commercial transactions between companies, creating a dynamic and competitive ecosystem that is transparent by design. Transcending the concept of a simple e-commerce site, it becomes a comprehensive e-procurement solution capable of managing the entire purchasing process, from sourcing and requesting quotes to payment and performance management.

There is no single type of B2B marketplace; several different types exist to meet specific needs:

- E-procurement marketplaces are designed primarily to streamline and control a company’s internal purchasing processes for all spending categories (direct and indirect). They provide employees with centralised access to catalogues of products and services from pre-approved and negotiated suppliers, thereby ensuring compliance with purchasing policies.

- Network marketplaces are designed to connect and facilitate transactions within a specific network, such as a purchasing group, franchise network, or professional federation. The aim is to pool the network’s purchasing power to obtain better terms while offering members a standardised platform.

- Circular economy marketplaces specialise in the resale, rental or recycling of second-hand goods, surplus stock or refurbished products. They enable companies to monetise their unused assets, reduce their environmental footprint, and access equipment at a lower cost. This directly supports sustainability objectives.

2. Comparative analysis: restructuring buyer-supplier interactions in marketplaces

The transition to a marketplace model is fundamentally altering the nature of the relationships and processes between buyers and suppliers.

Centralisation is a cornerstone of this change: the most fundamental change is the shift from decentralised, siloed activities to a centralised system. All supplier information, product catalogues, orders, invoices and communications are now consolidated in one place. This creates a ‘single source of truth’ that was previously inaccessible, thereby eliminating redundancies and inconsistencies.

From static to dynamic: unlike traditional supplier lists, which are often static and difficult to update, marketplaces create a fluid and dynamic environment. New suppliers can be discovered, evaluated and integrated quickly — often in a matter of days rather than months. The performance of existing suppliers is monitored in real time, enabling agile adjustments to the supplier base based on objective data.

Democratisation of access: B2B marketplaces help to level the playing field. They offer increased visibility to suppliers of all sizes, including the smallest and most innovative ones, enabling them to compete with established players. For buyers, this means greater choice, increased competition and easier access to innovation.

3. Traditional supplier management versus marketplace management

Discover how our multi-vendor purchasing solution can transform your procurement process into a strategic lever. Benefit from simplified management, better visibility on your expenses, and a rapid return on investment.

III. The revolution is underway, transforming the entire supplier lifecycle.

Adopting a B2B marketplace is more than just superficial optimisation; it fundamentally redefines every stage of the supplier relationship. From initial discovery to long-term collaboration, the platform acts as a catalyst for efficiency, control, and strategic value. This section provides an in-depth analysis of how this new model is transforming the supplier lifecycle, drawing on specific platform features and quantifiable data.

1. Sourcing and discovery: transforming shortlists into a global, data-rich talent pool.

The first stage of supplier management, sourcing, has undergone a radical transformation, evolving from a manual and limited process into a dynamic and global one.

Automated discovery: traditional sourcing methods, such as internet searches, specialised directories, and participation in trade shows, are time-consuming and offer limited scope. B2B marketplaces reverse this logic by using search tools and artificial intelligence algorithms to analyse global supplier databases in real time. This automation can reduce the time spent on market research by up to 90%.

Data-driven evaluation: supplier selection is no longer based on intuition or pre-existing relationships. Marketplaces provide enriched supplier profiles containing detailed, verifiable information about production capabilities, financial health, quality certifications (e.g. ISO) and CSR performance. Buyers can use advanced filters to identify suppliers that meet very specific criteria, such as geographic location, regulatory compliance or technical specifications.

Increased competition and price transparency: the platform model inherently promotes competition. By enabling buyers to easily and simultaneously compare multiple offers for the same product or service, marketplaces act as natural price regulators. This transparency encourages suppliers to offer their best terms. One case study showed that prices for recurring products fell by up to 15% after switching to an e-procurement marketplace, providing a rapid return on investment (ROI).

2. Integration and qualification: automating trust, compliance and transaction speed

Onboarding a new supplier is traditionally a major bottleneck, a cumbersome and risky process. The marketplace transforms it into a fast, secure and standardised workflow.

Streamlined workflows: the onboarding process, which used to take weeks or even months, is radically accelerated. Automation can reduce this time by up to 80%.

Centralised document and data collection: no more endless email exchanges and lost documents. Suppliers upload all required documents to their marketplace back office (tax forms, insurance certificates, compliance statements, etc.) in a single, secure space. The platform can define mandatory fields to ensure that no critical information is missing, guaranteeing a complete file before the commercial relationship even begins.

Automated verification and risk assessment: this is where a crucial innovation lies. Modern marketplaces integrate with third-party data services to automatically verify supplier information in real time. This includes validating bank account ownership to prevent wire transfer fraud, verifying compliance with anti-money laundering (AML/CFT) regulations, and monitoring ESG risk indicators. This continuous monitoring allows high-risk suppliers to be flagged before they are integrated into the supply chain, moving from a reactive due diligence approach to proactive risk management.

3. The Procure-to-Pay engine: gain complete control by centralising processes.

The Procure-to-Pay (P2P) cycle, which encompasses every stage from purchase requisition to payment, lies at the heart of procurement operations. The marketplace transforms this process into a unified, controlled and efficient one.

The marketplace centralises the entire P2P cycle on a single platform: from purchase requisition creation to invoice reconciliation and payment, providing a unified process. This replaces the disparate systems (ERP, emails and spreadsheets) that cause complexity, errors and a lack of visibility in traditional organisations.

Guided procurement and compliance: to eliminate uncontrolled spending, marketplaces offer all employees a simple, intuitive, B2C-like shopping experience, regardless of their familiarity with procurement processes. This approach, often compared to Amazon’s, is complemented by guided procurement features. The system directs users to products and services from listed suppliers at negotiated prices, while automatically applying the company’s purchasing policies. The goal is to achieve 100% user adoption and ensure full spending compliance.

Automated approvals and invoicing: purchase requests are automatically routed to the relevant approvers based on predefined criteria such as amount, expense category and cost centre, significantly reducing approval times. Invoice processing is also automated. Studies show that automation can reduce the median cycle time for issuing a purchase order from 35 hours to 24 hours. Some companies have even seen a reduction in purchase cycle time of up to 81% after automating their approval processes.

4. Performance et collaboration : des évaluations statiques aux partenariats dynamiques et en temps réel

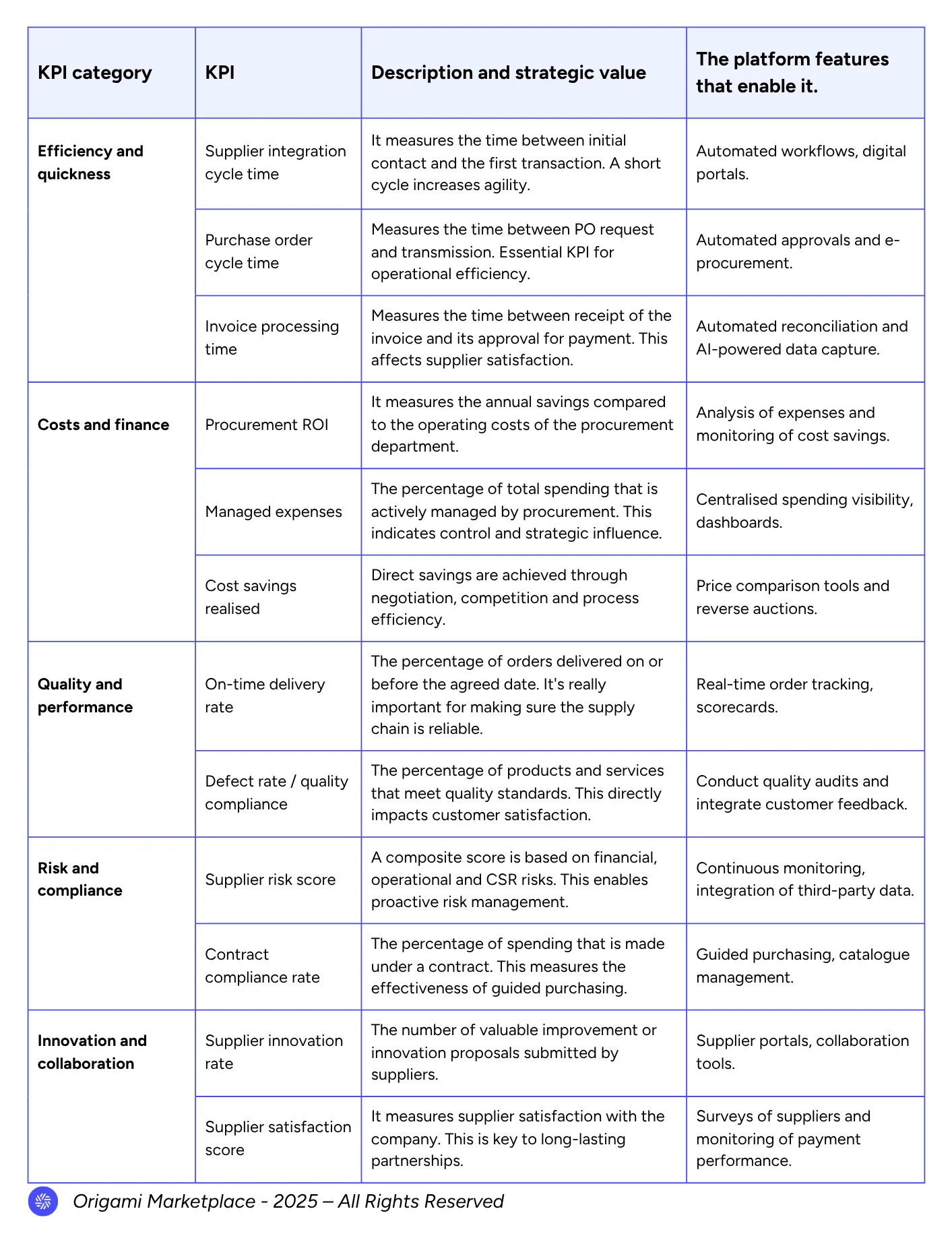

5. KPIs for managing suppliers via the marketplace

This table is a fundamental tool for the CPO because it operationalises the benefits of the marketplace. It provides a concrete list of indicators that the procurement department must monitor in order to improve performance. This demonstrates a shift in focus from merely measuring cost savings to measuring strategic value, resilience and innovation.

Conclusion

Adopting B2B marketplaces is not just an incremental improvement; it is a paradigm shift that fundamentally redefines the procurement landscape. By centralising data, automating the entire supplier lifecycle, and integrating intelligence into every process, marketplaces liberate procurement from the burden of manual, tactical tasks.

This transformation allows procurement to evolve beyond mere cost control and become a strategic driver of business value. They strengthen supply chain resilience, catalyse innovation in collaboration with suppliers, and ensure compliance in an increasingly complex and regulated world.

For procurement leaders, the time for observation is over. Those who embrace and drive this transformation will build a more effective procurement function and secure a decisive, sustainable competitive advantage for their entire organisation. The question is no longer whether this revolution will happen, but who will lead it.

To sum up: the B2B marketplace as an ally in your relationship with your suppliers

Traditional supplier management poses a significant challenge to many companies. It is characterised by manual processes that consume up to 84% of teams’ time, a lack of critical visibility, and purely transactional relationships. B2B marketplaces are transforming this landscape by centralising and automating the entire supplier lifecycle on a single platform.

The key transformations are:

- Radical efficiency: end-to-end automation of the sourcing, onboarding and procure-to-pay cycle reduces cycle times by up to 81% and new supplier onboarding time by up to 80%.

- Total visibility and control: data centralisation provides a comprehensive view of spending and suppliers, eliminating ‘wildcat’ purchases and enabling proactive risk management, including CSR compliance.

- Increased resilience: access to a large pool of pre-qualified suppliers enables diversification and makes the supply chain more agile, allowing it to respond quickly to disruptions.

- Strategic transition: freeing teams from manual tasks allows them to focus on high-value activities, such as collaborating and innovating with suppliers.

In summary, the marketplace transforms the procurement function, turning it from a tactical cost centre into a strategic driver of value, resilience, and innovation for the business.

👉 Need to digitise your procurement? We can help!